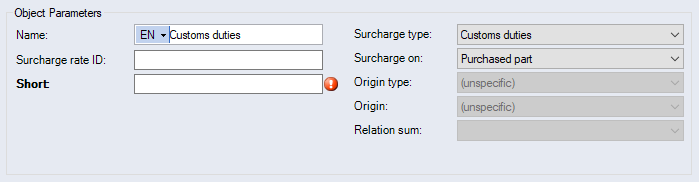

Configure Customs Duties in Data Administration

Further Information see Performing Maintenance Operations

Configure Customs Duties Calculation in the Costing Scheme

Customs duties can be surcharged ("Surcharge on") via a formula on the following cost elements:

|

|

|

The custom duty surcharge can also be used in other formulas. The calculated custom duty costs are shown at the purchased and standard parts, as well as at the inserted project.

Administer Customs Tariffs

- Open the Customs tariffs category under Basic data.

The "General" tab of the category opens.

-

Click in the row with the star

in the table.

in the table.A new customs tariff row is created.

-

Enter all required values.

-

Click Apply.

The data are saved in Data Administration.

Further Information see Customs tariffs

Assign country groups for locations and suppliers

-

Open Data Administration.

Open Data Administration.

Open "Data Administration"

-

In the ribbon, click on View >

Data Administration.

Data Administration.Alternative: Click

The "Data Administration" Dialog opens.

-

- Switch to the Origins category.

- Open a supplier or location.

- Switch to the Special tab.

- In the Address group, select a Country group.

Assign Country Groups and Customs Tariff Numbers for Purchased and Standard Parts

-

Open Data Administration.

Open Data Administration.

Open "Data Administration"

-

In the ribbon, click on View >

Data Administration.

Data Administration.Alternative: Click

The "Data Administration" Dialog opens.

-

- Switch to the Parts category.

- Select the Purchased Parts or Standard Parts folder.

- Switch to the Special tab.

- Select a Customs Tariff Number in the upper table Elements.

- Select an Origin Country Group in the bottom table Prices.

You can also import country groups and customs tariff numbers via the Excel Master Data Import.

The assignment takes places via:

- Abbreviation for the country group (Purchased Part Price Assignment)

- Commodity code for customs tariff number (Parts Assignment)